We have so many digital lenders in Nigeria, and Flexi Cash is one of them. Flexi Cash will display a ‘loanable amount’ for you to click and get instant loan, and sometimes the app will lend you money that you did not apply for. If you have borrowed from this app intentionally, accidentally, or unknowingly, you will find out here how to repay with PalmPay.

Just Something to Know About Flexi Cash

If you installed Flexi Cash, you would have seen a loanable amount of 500,000 naira to pay back in 180 days, and also an opportunity to borrow 1,000 with a daily interest of one naira per day. This might have attracted you to apply, or you unknowingly received money from Flexi Cash.

And by the way, Flexi Cash services are provided by Bloom MicroFinance Bank Ltd. We have thoroughly reviewed Flexi Cash, and encourage you to read this review.

You need to have a PalmPay account to use Flexi Cash, so, don’t be confused if you see both apps being mentioned together. As part of Flexi Cash terms and conditions, they will obtain your personal and bank information from your PalmPay account, including your name, gender, date of birth, email address, mobile device number, bank verification number (BVN), etc.

Flexi Cash Repayment on PalmPay

This repayment is explained in 3 ways. Simply skip to the section that applies to you. But note that all three instances have a similar repayment method, which we will talk about.

1. Flexi Cash overdue repayment

PalmPay’s Flexi Cash can call you on the due date of your payment as a reminder. But unlike some of the loan sharks we’ve reviewed, they won’t immediately call your contacts or harass, which is against Google’s policy and, of course, the FCCPC’s (Federal Competition and Consumer Protection Commission). But there are reports that at some point, like after 5 to 7 days of no repayment, they may start reaching out to your contact.

If you are owing Flexi Cash, you will see Current Outstanding on your dashboard. All you have to do is fund your PalmPay account, and the loan will be repaid automatically. In your transaction history, you will see Flexi Repayment.

After clearing your debt, Flexi Cash should remove the credit freeze for late repayment on your account. Tap Apply for Unfreezing. You’ll see this option on your account dashboard.

If Flexi Cash thinks that you don’t have a good credit with them, they will decline with a message that “Your application for unfreezing was declined due to your low credit.” Try to carry out more transactions on PalmPay to improve your credit.

2. Repaying your loan on or before due date

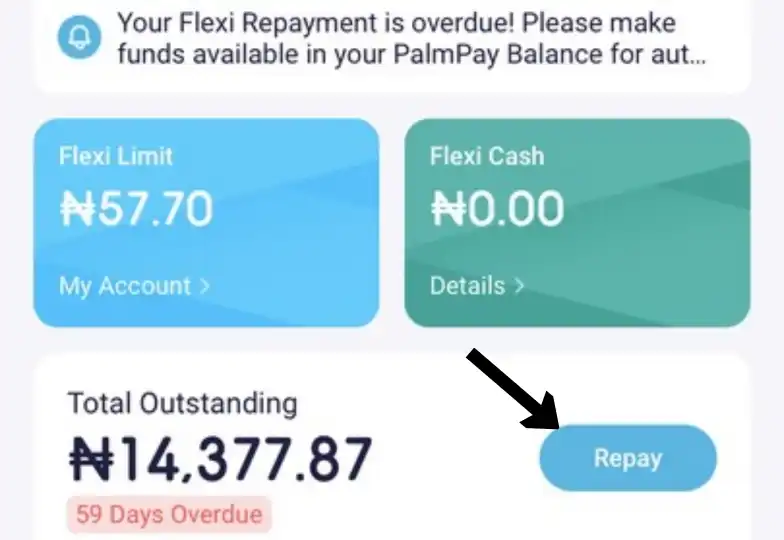

You can simply tap the Repay button on your Flexi Cash dashboard for your PalmPay repayment. While it’s not a good practice, Flexi Cash welcomes repayment before due date. The same Repay button can be used if you have an outstanding debt.

It’ll be something like this:

Image source: Nairaland.com

To repay, you will need to fund your PalmPay by clicking on Fund on the PalmPay app and using USSD, bank card or transfer to fund your PalmPay account. Once you make your loan repayment, you may be eligible to borrow again.

3. Flexi Cash says you owe money but you didn’t borrow from them

Reports have been making rounds that Flexi Cash sometimes credits people without their consent. For some people, the app will show that you owe an outstanding balance, even though you did not borrow any money. Some receive the said amount to be paid back in 7 days.

If you didn’t take any loan from this app, and your credit limit is frozen due to an outstanding balance, don’t fund your PalmPay account. The money will be taken, and you have to pay for something you did not collect. Instead, notify both Flexi Cash and PalmPay about this error. It’ll be fixed.

You have to be careful while using this app so that you don’t accidentally apply for a loan. A lot of people have complained about receiving Flexi Cash loans they did not apply for. Just be careful if you are new to the app. Also, as a borrower, don’t apply for a loan amount more than you can afford to pay back. Instant loan apps are in business.

![NeoCash Loan App Review [Legit or Scam in 2024?] NeoCash Loan App Review [Legit or Scam in 2024?]](https://instantmoneyapp.com/wp-content/uploads/2024/02/PicsArt_02-26-10.56.16-211x150.webp)