You only installed a loan app because you need quick cash to fix personal issues. However, some of them do more than just disburse a loan; they peek into your personal information, including your photos. This only happens if you allow the app access to your files and gallery.

Moreover, it is against Google policy for a loan app to access your photos. Even the FCCPC (Federal Competition and Consumer Protection Commission) is against this intrusion. But some loan apps, even the licensed ones, still require this access, and when you grant them, they go on to pull copies of your photos that could be used against you in the future if you default. But that’ll stop right here because you’ll find out what to do to end this instant lender menace.

Loan Apps Can Access Your Gallery and Pics: Here’s How

When you install a loan app, some will ask you to give them access to your gallery and device files. If you grant this access, the app will obtain copies of your photos. If you have any sensitive photo in your phone, you can be certain that the lender sees them all.

Now, what they can do with your photos is a whole lot of stuff. Usually, however, they keep it until you default on a loan. Then they use it to publish false information about your person.

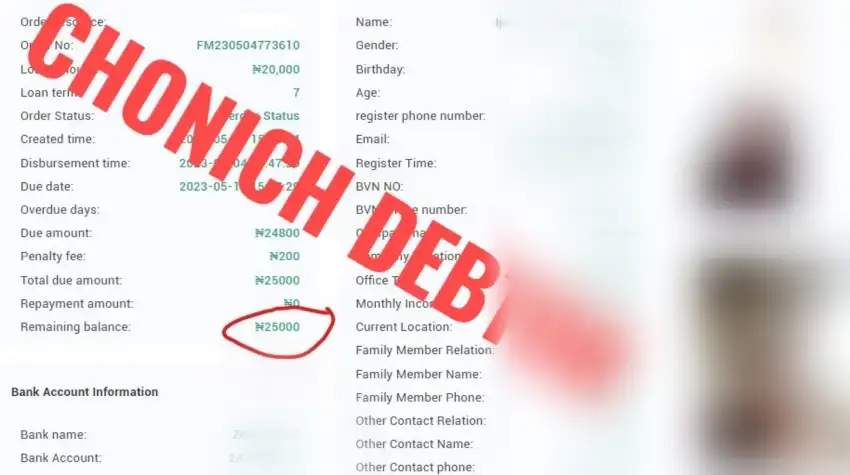

I picked up one from the web just so you can see the extent to which an instant lender can go if you default on a loan.

Source: Nairaland

The blurred sections contain sensitive information. So, I have blurred the information for privacy reasons—something loan apps do not do.

There are multiple ways a loan shark can use your picture to get you to clear your debt. These are typically defamatory, and not an experience you’d want to find yourself in.

What to Do to Stop Loan Apps from Accessing Your Pictures

1. Deny It Permission to Access Your Gallery

When installing a loan app, it shouldn’t ask for access to your gallery because it’s against Google Play Store policy. If you can’t find a loan app on Play Store or Apple App Store, the chance is that it is fake. Moreover, it’s difficult to report an app that is not on Google to Google.

Some loan apps won’t allow you to proceed with a loan application without access to your gallery. If that’s the case, report the app to Google. It’s not worth it leaving your personal images at the mercy of someone you don’t even know. If you still want to use the loan app, then it’s best you do so on a device that doesn’t have your pictures.

2. Uninstall the Loan App

If you already have a loan app installed, and all permissions granted, it might be too late as the lender may already have copies of your photos. Nevertheless, uninstall the app and report it to the app store where you downloaded it.

3. Report the Loan App to Google

Google’s policy prohibits loan apps from accessing your contacts. Do the following to report a loan app that has accessed your device gallery:

- First, go to support.google.com/ googleplay Android policy violation report

- Enter your name

- Enter the application package name (example com.example.app)

- Under Suspected Policy Violation, select Privacy Violation, Deception or Misrepresentation because this is where Google classifies loan apps

- Under Violation Type, select User Data

- Under Policy Violation Subtype, select Personal and Sensitive User Data

- Under Where did you find the suspected policy violation? select While Using the app.

- Under Is the application still available on Google Play? select Yes or No, as it applies. That’s all.

Be rest assured that Google will take action. Sometimes, they delist such apps and ban the lender from using the platform again. This is one of the reasons you see loan apps changing names every day because their former has been banned or blacklisted.

4. Notify the FCCPC

The FCCPC (Federal Competition and Consumer Protection Commission) is also against loan apps accessing your contacts. Below are simple steps any Nigerian can take to report a shady Nigerian loan app to the FCCPC:

- Go to complaints.fccpc.gov.ng

- If it’s a new complaint, select New

- If you have complained to the loan app, select Yes

- If your complaint with the lender is up to 2 weeks, select Yes

- If the loan app has not acknowledged your complaint, select No

- Click Proceed to Complaint

- Under Categories, select Digital Money Lenders

- Enter your personal information, including your name, state, phone number and email

- Click Save and Continue

- File your complaint and submit to the FCCPC

Another method is to write the FCCPC through their email at lenderstaskforce@fccpc.gov.ng. Of course, your report should carry all the necessary evidence, including screenshots of the violations, your complaints to the lender, their responses, etc. Note that the FCCPC requires you to contact the digital lender first before writing to them about any violations you have experienced.

That’s it. Never hesitate to file a complaint if you have been treated unfairly by a loan app. And most importantly, do not borrow an amount of money you can’t afford to pay back. If the interest rate or the general loan term is different from what you were promised, contact the lender immediately and refund their money to avoid damaging your credit history.