You no longer have to keep saving and waiting until you have the complete money for an Android phone or tablet. This is what the device loan by ALAT is meant for. You buy a device of your choice, and repay little by little until you repay the full amount. However, you have to know what you’re getting yourself into before taking this loan, and that’s the purpose of this honest review.

ALAT is a digital bank owned by Wema Bank Plc. ALAT is legit, and fully licensed by the CBN (Central Bank of Nigeria) and deposits are insured by the NDIC (Nigeria Deposit Insurance Corporation). This app is not listed in the FCCPC (Federal Competition and Consumer Protection Commission) list as it’s not solely a digital lending app. The address is Wema Towers 54, Marina Lagos Island, Lagos. The website is alat.ng.

Is ALAT Device Loan Legit?

ALAT is perfectly legit, and licensed by the CBN. It is a very good app for borrowing to buy a device on credit. There’s a lot about this device loan that makes it not worthy. Hopefully, ALAT will do better with time, but it’s not the best currently.

ALAT charges a monthly interest rate of 5% for this loan. It’s low because it’s an app offered by a commercial bank, Wema.

This loan isn’t predatory but it does not have many options to select from, which is the biggest disadvantage.

First, the only type of device CURRENTLY available (at the time of publishing this review) is Android. No, there’s no iPhone, laptop, etc., when applying from the app. There’s also no loan offer for laptops, speakers, headphones, and other devices.

Secondly, ALAT device loan only supports one store at the moment, which is called Sentinel. Therefore, the device available depends on this store. Sentinel store is located in Port Harcourt, Rivers State. I don’t know why it’s just one vendor. Perhaps other vendors are not yet aware, or ALAT isn’t publicizing this well? But this loan feature has been around for sometime now, enough to attract more vendors.

The third observation is that this loan requires your salary information. As for the device availability, the inventory is endless. Most of the popular, low-range, mid-range, and high range devices are available, from Infinix, Tecno, Itel, Redmi, Samsung, etc. This loan supports them all.

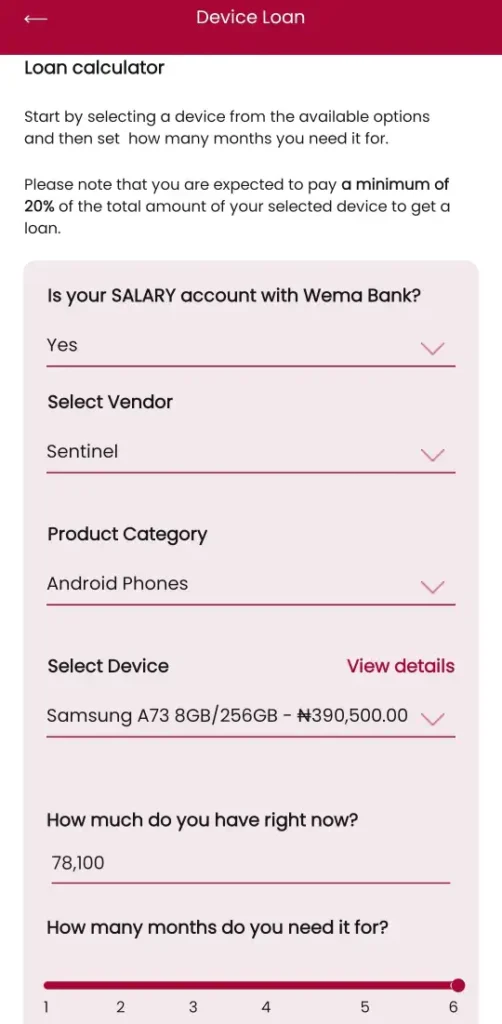

ALAT also requires you to make a 20% down payment on the total amount to qualify for this loan. For example, if a device is worth 100,000 naira, you have to put down 20,000 naira, and then the rest is on credit.

There’s a loan tenure limit of 6 months, unlike other traditional loans from this lender that can stretch up to a year.

If you can’t meet up with paying back your loan, you can contact ALAT to discuss an extension of the deadline to help you clear your debt. It will come on their own terms, and ALAT may modify your interest rate.

ALAT considers your credit history before disbursing this loan. If you have not repaid your old loans with other digital lenders and banks, you’ll likely not qualify for this offer.

One thing to like about this loan is that you don’t need a Wema bank account for it. You just have to sign up on ALAT.

How Does ALAT Device Loan Work?

ALAT gives a device loan of any amount. You repay with 5% every month.

Let’s say you’re buying a Samsung phone of 390,500 naira. You’ll have to make a down payment of 78,100 naira because ALAT requires you to make a 20% down payment.

Remember, you have 6 months. Let’s say we are taking this loan for 6 months. This loan attracts 5% interest every month. So you’ll be paying 61,548.26 every month for 6 months.

How to Get ALAT Device Loan

If you already have the ALAT app, then you’ll skip the sign up steps and log into your account. For new people, continue with the sign up process below.

- Go to Google Play Store or Apple App Store and install the ALAT app. If the ALAT app makes it difficult to open a new account, use the web app online.alat.ng

- ALAT will require your BVN, photo of your face, and photo of Valid ID (NIN slip, international passport, national ID, voters card, or driver’s license)

- Agree to the terms and conditions, and click Proceed

- Enter your country of residence, phone number, and email address

- Enter your BVN

- Take a selfie photo of your face

- Click Verify Identity

And welcome to ALAT. You’ll need other information for your KYC (know your customer), which will include your proof of address like your light bill. If you just want the bank to handle the sign up process, then enter any Wema nearest to you. But everything can be done online, and you’re ready to borrow for a phone.

When you have created your account, you are ready to apply for a ALAT device loan.

- Sign into your account via ALAT app

- While on your account dashboard, look down your screen and click the Loans tab

- The tab it’ll take you to is the Manage Loan. Now, click the tab that says Take Loan

- Click Device Loans

- You’ll arrive in the Loan Calculator, where you’ll select the vendor, device category, device type, and your preferred loan tenure (1 to 6 months)

- Click Proceed

- Submit your employment information, including your industry, employer, and work ID

- Click Proceed again, and complete the remaining information

If you have followed this tutorial correctly, you should see something similar to this:

As for the eligibility, you have to be at least 18 years old and a Nigerian.

Pros and Cons

The ALAT device loan comes with its own unique advantages and disadvantages.

Pros

- No hidden charges like loan sharks

- Available on Google Play Store and Apple App Store

- Fully licensed by the CBN

- 5% monthly interest rate

- Owned by a commercial bank, Wema

Cons

- Repayment tenure is only 6 months (this is subjective)

- You have to submit your employment information and ID

- Requires good credit history

- Currently supports only one phone store

- Only Android devices available

- Requires 20% down payment

Is Your Personal and Bank Information Safe with ALAT?

ALAT has not had any major customer data abuse reports, and you can trust this digital banking app with your personal and bank information. It is owned by Wema, a CBN-licensed commercial bank. However, the Premium Times reported in 2022 that Wema Bank was being investigated by the NDPB (Nigeria Data Protection Bureau) for opening accounts for customers without their permission.

Personal information collected includes your name, age, email address, phone number, personal description, marital status, state, photograph, NIN, and home address (such as utility bill). Bank information collected by ALAT includes your BVN (bank verification number).

When you install the ALAT app, information collected from your device, with your permission, includes your installed apps, device ID, device type, IMEI, GPS information, device operating system, IP address, personal contact numbers, call logs, and SMS logs.

It’s up to you to make this decision. ALAT app may not be a perfect quick loan app in Nigeria but one thing they do is actually give quick loans with low monthly interest rates.

ALAT is a legit lender because of its current CBN license. However, this loan offer is not good enough. As such, it gets a 2 out of 5 rating. More stores and other devices have to be added. The loan tenure should be increased to 1 year. Otherwise, it’s a good loan if you are employed.